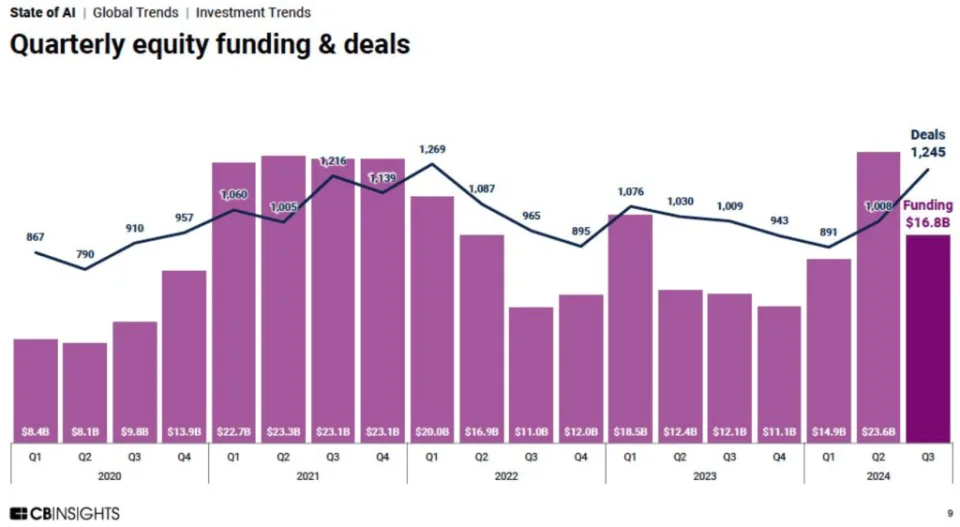

The AI industry is experiencing a significant surge in investments in 2024, surpassing 2023 levels even before Q4, with a reported $55.3 billion in funding through Q3. This represents a $1.2 billion increase from 2023’s total of $54.1 billion. If the trend continues, 2024 could potentially exceed 2022’s $59.9 billion in AI investments, although it will likely remain well below the 2021 peak of $92.2 billion, driven by favorable tech conditions and low interest rates.

Key Highlights from 2024 AI Investment Data:

- Investment Volume:

- $55.3 billion in global AI funding through Q3 2024.

- Significant mega-rounds, such as OpenAI’s $6.6 billion and Elon Musk’s xAI raising $6 billion.

- Deal Activity:

- 1,245 deals in Q3 alone, marking a 23% increase year-over-year compared to Q3 2023.

- A total of 3,144 deals by Q3 2024, with the year poised to surpass 2023’s total of 4,058 deals.

- A notable shift toward “mega-rounds,” with 51% of Q3 and 69% of Q2 deals exceeding $100 million.

- Key Players:

- OpenAI now valued at $157 billion, with substantial contributions from Nvidia, Fidelity, SoftBank, and Microsoft.

- Elon Musk’s xAI valued at $24 billion following a $6 billion funding round.

- New ventures, like Ilya Sutskever’s Safe Superintelligence, raised $1 billion, showing investor confidence in experienced AI leaders.

- Venture Capital Trends:

- Focus on established names and proven projects, with fewer speculative bets on emerging startups.

- Challenges in VC fundraising, potentially alleviated in 2025 if anticipated lower interest rates materialize under the next U.S. administration.

Industry Outlook:

The increasing concentration of funding in a few dominant players suggests a maturation of the AI market, favoring established entities over untested ventures. While 2024 investments may not break the 2021 record, the current trajectory highlights sustained confidence in AI’s transformative potential. However, challenges remain in democratizing opportunities and ensuring broad-based economic impacts beyond major tech players.

Leave a Reply